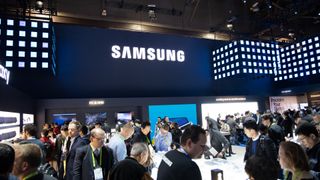

Samsung profits set to drop by 60 per cent

Slowing smartphone market impacts earnings

Samsung is set to post its lowest quarterly profits in two years, telling investors it expects a drop of around 60 per cent when it publishes its first quarter accounts.

The Korean electronics giant expects revenues to be around 52 trillion won (£35bn) and profits to be to 6.2 trillion (£4.2bn) – missing market expectations.

The fall can be attributed to slowing smartphone sales, a fall in the price of memory chips and lower demand for displays panels.

- Samsung to miss revenue expectations

- Chinese vendors account for a third of the market

- What is 5G? Everything you need to know

Samsung profits

In addition to being the world’s largest mobile phone manufacturer, Samsung is a major supplier for its competitors – including great rival Apple - who rely on the company for components. This means it is particularly susceptible to a lack of growth in the market.

Such was Samsung’s concern about the situation, it took the unprecedented step of issuing a pre-guidance warning last month in order to communicate with shareholders as soon as possible.

There is some hope for a turnaround, however. The cost of memory chips is expected to rise and there is an expectation among all smartphone vendors that flexible displays and 5G will stimulate the market and encourage consumers to purchase new devices.

The increased cost of handsets, a perceived lack of innovation, and a lack of new markets to exploit have all been cited as contributing factors to a general fall in sales.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

ABI Research believes that shipments will rise 4.1 per cent to 1.6 billion 2019, with further growth expected in subsequent years.

- Here are the best Samsung phone deals

Steve McCaskill is TechRadar Pro's resident mobile industry expert, covering all aspects of the UK and global news, from operators to service providers and everything in between. He is a former editor of Silicon UK and journalist with over a decade's experience in the technology industry, writing about technology, in particular, telecoms, mobile and sports tech, sports, video games and media.