Samsung's biggest memory rivals are plotting a tie-up with Kafkaesque implications — SK Hynix and Kioxia could build lucrative HBM chips for Nvidia, AMD and others

The move could make SK Hynix the dominant HBM manufacturer

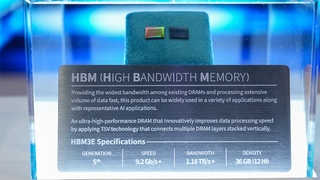

South Korean chipmaker SK Hynix, a key Nvidia supplier, says it has already sold out of its entire 2024 production of stacked high-bandwidth memory DRAMs, crucial for AI processors in data centers. That’s a problem, given just how in demand HBM chips are right now.

However, a solution might have presented itself, as reports say SK Hynix is in talks with Japanese firm Kioxia Holdings to jointly produce HBM chips.

SK Hynix, the world’s second-largest memory chipmaker, is a major shareholder of Kioxia, the world’s No. 2 NAND flash manufacturer, and if the deal goes ahead, it could see the high-performance chips being produced at facilities co-operated by Kioxia and US-based Western Digital Corp. in Japan.

A merger hangs in the balance

What makes this situation even more interesting is Kioxia and Western Digital have been engaged in merger talks, something that SK Hynix is opposed to over fears this would reduce its opportunities with Kioxia. As SK Hynix is a major shareholder in Kioxia, the Japanese firm and Western Digital’s merger can’t go ahead without its blessing, and this new move could be seen as an important sweetener to help things progress.

After the news of the potential deal broke, SK Hynix issued a statement saying simply, “There is no change in our stance that if there is a collaboration opportunity, we will enter into discussion on that matter.”

If the merger between Kioxia and Western Digital does proceed, it will make the company potentially the biggest manufacturer of NAND memory on the planet, leapfrogging current leader Samsung, so there's a lot to play for.

The Korea Economic Daily says of the move, “The partnership is expected to cement SK Hynix’s leadership in the HBM segment, which it almost evenly splits with Samsung Electronics. Kioxia will likely transform NAND flash lines into those for HBMs, used for generative AI applications, high-performance data centers and machine learning platforms, contributing to a revival in Japan’s semiconductor market.”

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

More from TechRadar Pro

Wayne Williams is a freelancer writing news for TechRadar Pro. He has been writing about computers, technology, and the web for 30 years. In that time he wrote for most of the UK’s PC magazines, and launched, edited and published a number of them too.